Skrill/Moneybookers Overview |

| About Skrill/Moneybookers | Skrill is an electronic-business that allows people to make payments through the Internet. The product stores securely financial details, so customers won’t have to enter card numbers, expiry dates and endless details. The payment system offers an online deposit account and an internet-based alternative to transfer options like cheques, money orders and wire transfers. |

| Website URL | https://www.skrill.com/en/ |

| Headquarters | 25 Canada Square, London, United Kingdom |

| E-mail | - |

| Products | Payment gateway, Digital wallet, Prepaid card, PSP |

| Languages | English, German, France, Espanol, Italian, Polski, Russian, Greek, Turkish, Czech, China |

| Account Currencies | EUR, GPB, USD, AUD, CAD, CZK, DKK, HKD, JPY, HUF, BGN, LVL, TWD, THB, ILS, EEK, NOK, PLN, NZD, MYR, SGD, ZAR, KRW, SEK, CHF |

| Types of Skrill Account | Personal, Business |

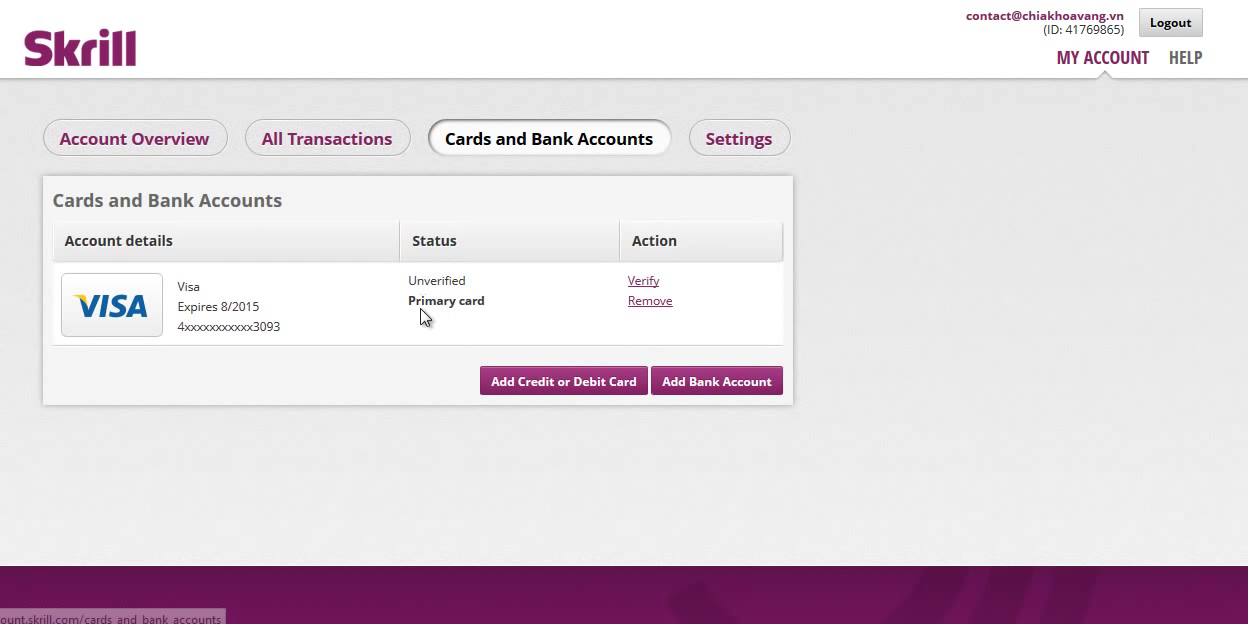

| Deposit Options to Skrill Account | Bank deposits, Credit/debit card |

| Fees to Deposit to Skrill | Credit and debit card deposits are fee of 1.9% |

| For Currency Conversions | Skrill adds 2.49% to the wholesale exchange rates for foreign currency |

| International Bank Transfer | Free (American Express, Visa, MasterCard, JCB, Diners Club: 1.90%) |

| Security | Highest encryption standards will keep your information safe. Skrill continually updates the system to protect your money |